Samson, a very important content people affiliate, provides more twenty years of experience in a house secured lending (RESL) and capital…

Dining table out of material

While looking for home financing inside Canada, you may get a hold of the phrase base factors otherwise BPS. Exactly what perform these types of words depict, as well as how perform it impact their home loan? And what is a foundation section? Here’s our very own complete help guide to mortgage basis points to help you build way more advised behavior regarding the financial.

What is actually a factor Point (BPS)?

From the simplest terms, financial basis items, otherwise BPS to have small, was a beneficial product away from dimension accustomed show the change during the financial rates of interest.

Just how much Is actually a factor Section?

1 base point equals 0.01% otherwise 1/100th from a %. Eg, in case the interest rate to the a home loan is 4.00% and you may increases because of the twenty five base situations, new interest rate is 4.25%. Also, if the interest rate reduces by 50 base points, the rate of interest might be step three.50%.

As to the reasons Have fun with Foundation Products Rather than Percentages?

Basis situations help beat any possible misunderstanding related percentages and you may explain discussions from interest levels. Using percent to explain changes in interest rates is almost certainly not completely appropriate. Therefore, mortgage lenders will say the pace enhanced of the X quantity of foundation products provide much more clearness.

How can Base Affairs Work with Mortgages?

Exactly what will be understood is the fact base facts can be used by the lenders and you will home loan pros to generally share short changes in rates, due to the fact also a-1 % improvement in the newest market’s rate of interest is also significantly impression your mortgage payment.

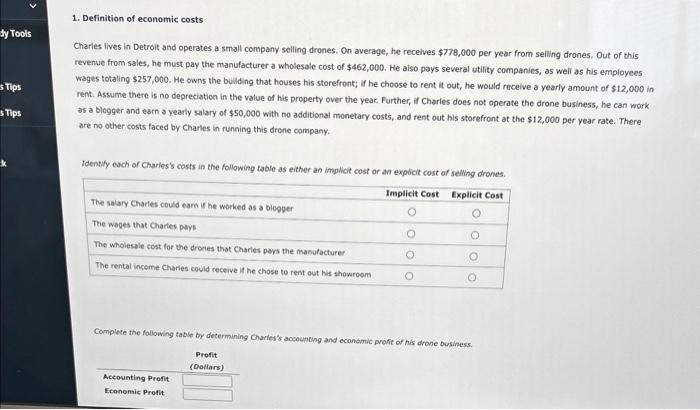

Eg, a 1% (100 bps) rise in the speed with the a beneficial $300,000 home loan that have a 25-12 months amortization period manage bring about an additional $ payment. (Within this analogy, using a growth off step three.75% so you’re able to 4.75% which have a particular payment change from $1, in order to $step 1,.)

A small change in basis items might have a negligible impression towards a small home loan, but a massive improvement in basis circumstances could cause a beneficial extreme raise otherwise reduced amount of monthly obligations for a big home loan.

A reputable on the web foundation section calculator you’ll come in handy whenever learning why you might be paying much more for the monthly mortgage repayments, but it is constantly far better speak to your financial.

Exactly how Is Basis Factors Computed?

Calculating BPS is fairly effortless once you understand tips move base issues toward percentages. The good news is, the math is quite easy to see-zero algebra is necessary!

To help you calculate BPS manually, the latest fantastic laws is the fact step one base area equals 0.01% otherwise 0.0001. For this reason, to convert foundation points to percentages, divide by 100. To alter percent so you’re able to base factors, multiply by 100. Find out how effortless that’s?

Figuring Foundation Issues and Repaired-Rates Mortgages

Having a predetermined-rates financial, the pace stays undamaged for the entire loan label. If your rate of interest has increased by the payday loans Pennsylvania twenty five basis products, you could assess new rate by adding twenty-five base circumstances (or 0.25%) on the totally new rate of interest.

Such as for example, can you imagine your brand spanking new interest are 3.50%. Calculate the rate of interest by adding 0.25% (or twenty-five BPS) to three.50%.

Say the pace on an excellent $three hundred,000 mortgage having a 25-seasons amortization several months enhanced by the 0.25%. That would bring about an extra $ when you look at the monthly obligations.

Figuring Base Things and you can Arms

When you yourself have a changeable-price home loan, the speed can alter over time, constantly predicated on a benchmark rates. In the event the interest rate has increased by the 100 base things, you could potentially calculate the newest interest adding 100 BPS (otherwise 1.00%) towards the brand-new interest.

Can you imagine your interest is actually 4.00%. You would put 1.00% (or 100 base affairs) in order to 4.00% in order to calculate new rate of interest.

It is critical to note that the rate changes sporadically which have a variable-rates financial (ARM). The bank regarding Canada (BoC) determines this new volume and you will amount of interest rate changes. The pace can increase or fall off with transform with the Secret Policy Rates (Financial of Canada’s standard speed).

When you yourself have a varying-speed financial, your monthly installments can also transform if rate of interest changes. Thus you might have to plan for a top homeloan payment should your interest rate rises otherwise a reduced mortgage repayment if the interest rate decreases.