Do not be conned called that 2nd one. You are qualified if you are buying a property within just in the one rural urban area and many suburbs. While the a bonus, you don’t need to be engaged into the farming by any means in order to meet the requirements.

You may have noticed the definition of “main the” during the “a few chief variety of financial and no deposit.” That’s because there are many more, smaller of them. Such as for example, Ds provide particularly revenue so you can doctors and you can surgeons, and many anybody else do to most other medical researchers. Meanwhile, regional apps may provide help some other categories of key specialists, such earliest responders or educators.

Va finance

Va funds are among the most well-known types of zero-down-percentage mortgage. Due to the fact label suggests, they have been offered merely to veterans and you will most recent servicemembers. If you are you to definitely, and you can haven’t been dishonorably released, there can be a top possibility your be considered. Yet not, there are numerous Va qualification legislation, mostly towards timing and you may duration of your own provider.

With our money, you pay a single-date money percentage initial. That’s already 2.3% of your financing value having earliest-date consumers making zero downpayment, although it you will improvement in the long run. Luckily you can one with the mortgage instead of discovering the cash.

Virtual assistant loan positives and negatives

Yet not, you will find constraints with this, as well as one settlement costs we wish to retract on mortgage. That’s because you simply can’t use over 100% of the appraised market value of the house. So you may need to find an empowered merchant or a good bargain the home of be able to have sufficient room locate all your costs on the loan. Its a misconception that people with Va money is also force a beneficial supplier to cover closure and other will cost you.

You to definitely resource percentage are a soreness. But it is and a true blessing. Because it substitute the brand new monthly financial insurance most buyers shell out, whenever they can not improve a great 20% advance payment. Throughout the years, it could help you save a lot of money.

The newest Va will not put any minimum thresholds getting credit scores. However,, because explained a lot more than, personal lenders can get — and more than create.

USDA finance

You are forgiven getting of course, if USDA loans payday loan Istachatta try categorized Most readily useful Secret. Too few individuals have also been aware of all of them. Unnecessary who have observed all of them guess they’re just for men and women engaged in farming or perhaps who would like to alive into the a rural backwater. But none of these holds true.

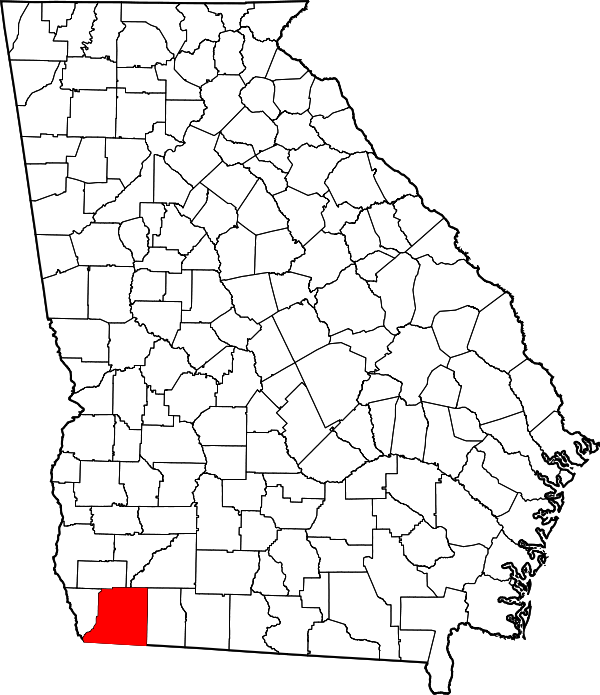

In fact, many guess one 97% of the landmass of one’s United states falls inside region qualified to receive a USDA loan. New USDA website provides a lookup device you to definitely lets you search for personal details one qualify. Plus it comes with lots of suburbs. At the same time, there is absolutely no specifications knowing that end out-of an effective tractor — or even of a hoe — about most other.

USDA funds: Eligibility and you will standards

You can find, not, specific individual qualifications difficulties which could excursion right up many. These types of funds developed for moderate- and you will reduced-earnings family and individuals. Therefore can’t earn much more than 115% of the average money close by. How much cash would be the fact? Once again, the brand new USDA site allows you to evaluate income limitations condition of the state. More members of your family, the greater amount of you can earn nonetheless meet the requirements.

If you get one, you’re going to have to spend a charge of just one% of amount borrowed inside your settlement costs. This commission should be put into their financial harmony, if you never obtain altogether over 100% of your own residence’s appraised market value.