Yet not, in the houses increase, many which could have eligible for a timeless home loan alternatively took aside a beneficial subprime mortgage, partly on account of competitive large financial company strategies, such as for instance granting loans easier or otherwise not fully explaining stricter fees words [source: Brooks]

Home ownership is definitely touted as “Western dream” – a beneficial palpable possibility that the savings perform if at all possible manage to provide to all of the doing work friends. But not, some activities from the advanced economic climate caused the houses atic boom and bust within the basic s. Among the products one to triggered the rise and you can remarkable fall of your s, entitled subprime mortgage loans, and therefore allow those with shaky credit ratings so you can safe lenders.

Nonetheless they remind repeated refinancing to find an effective “better” price, right after which roll brand new higher closing costs inside mortgage

The technique of financing currency to people having a failure or limited credit rating is known as subprime financing. One to myth concerning the identity “subprime” would be the fact it refers to the rates of interest connected to the funds. “Subprime” essentially is the credit score of the debtor. Subprime borrowers generally have a credit score below 620 towards a beneficial size of more or less three hundred so you’re able to 850 (otherwise 900, with regards to the form of rating system put). Very consumers result in the latest middle https://paydayloanalabama.com/tarrant/ to high 600s and 700s.

- credit score

- quantity of downpayment

- quantity of delinquencies (later money noted on your credit report)

- type of delinquencies

The newest evident escalation in subprime mortgage financing began regarding the middle-90s and you will taken into account approximately 20 percent out-of mortgage brokers in the 2006 [source: Federal Set-aside]. On together with front, subprime mortgages ensure it is individuals with less than perfect credit an opportunity to rating to your market in earlier times unavailable in it that have important mortgage brokers. The fresh disadvantage for the situation is the fact this type of money much more attending enter into standard, and so the debtor does not build payments towards financing. The huge amount of foreclosure away from subprime mortgage loans has had good drastic impact on the brand new You.S. casing breasts and financial crisis. Loan providers was indeed also strike difficult, with supposed below totally.

A new bad facet of the subprime marketplace is an upswing from inside the allegations one lenders target minorities – a habit labeled as predatory lending. These lenders sufferer upon the latest inexperience of your debtor in several suggests. They may overvalue your property, overstate your income if you don’t rest regarding your credit score into the order to set heavens-higher rates.

In this post, we will take a look at some examples away from subprime mortgages so you can determine whether one was effectively for you.

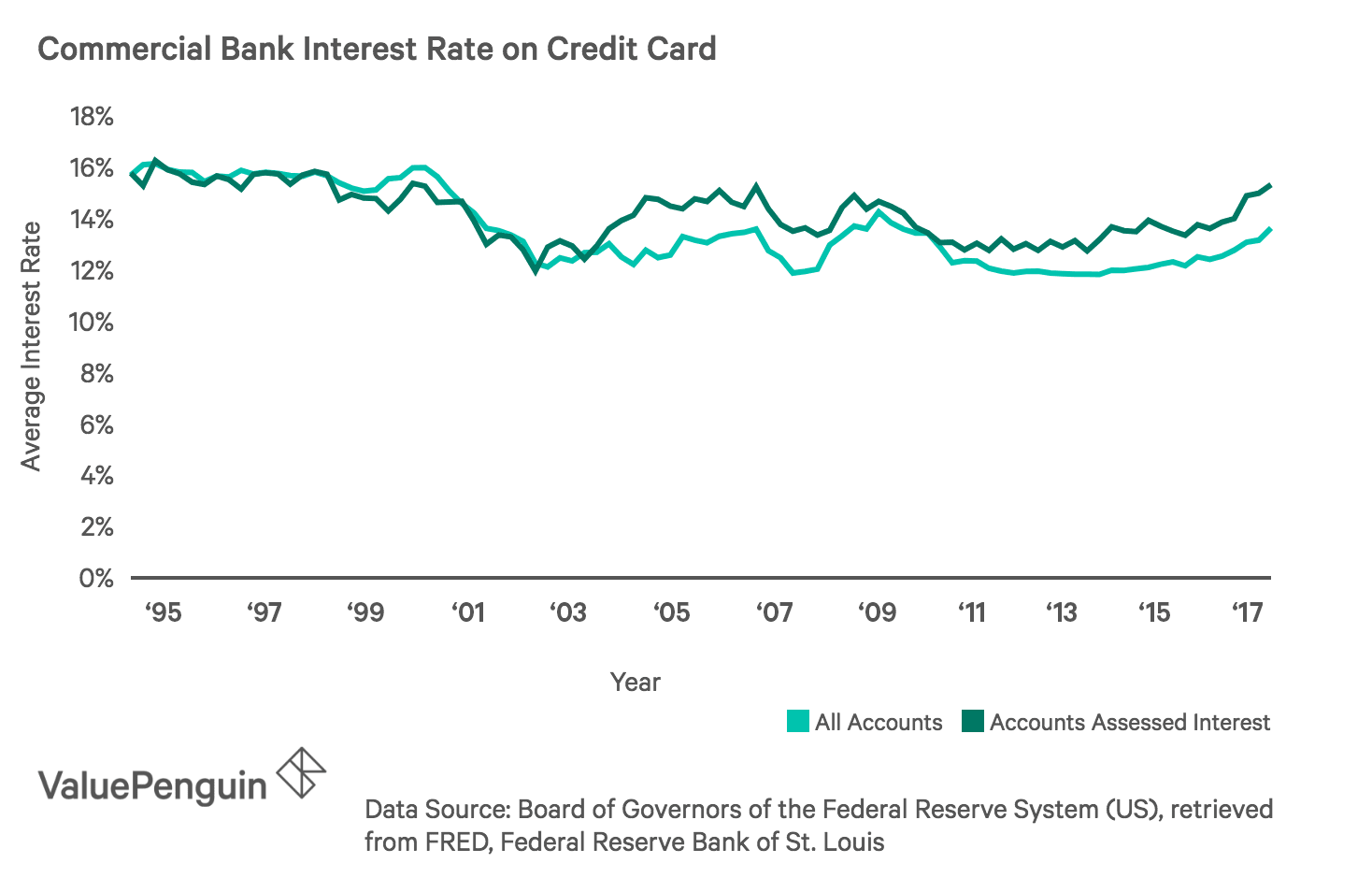

Subprime mortgage loans can be found in all the sizes and shapes. The main one factor that is generally uniform across-the-board would be the fact the interest rate might be more than the prime rates founded of the Federal Put aside. The top rates is what loan providers charges people with a good credit score evaluations.

Just about the most common subprime money keeps a variable-rate mortgage (ARM) affixed. Palms turned increasingly popular when you look at the houses growth because of their 1st lowest monthly obligations and you will low interest rates. Basic prices getting Fingers normally history two or three decades. The speed is then modified every six so you’re able to 12 months and you can payments increases up to 50 % or even more [source: Bankrate]. For people who discover a two/28 or a beneficial step three/twenty seven Case, the original number refers to the while at introductory rate, the following on the very long time in the remaining months of one’s financing which are susceptible to this new changing rate.