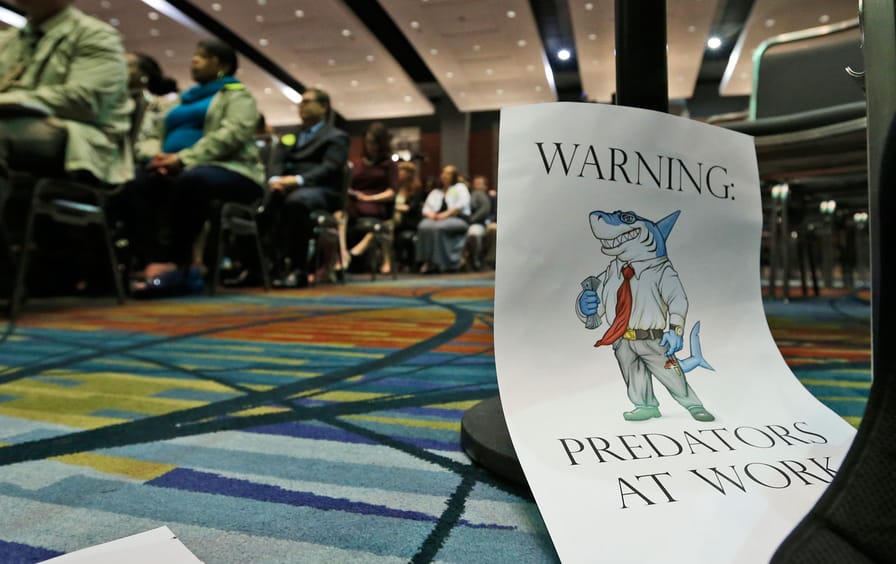

- They promise a 2% rate of interest.

- They promise dominating reduction.

- They tell you that there is no need tax returns.

- They reveal they are able to reduce your payment in the place of taking any suggestions from you.

- They aren’t a great Nj-subscribed attorneys otherwise a beneficial Nj-new jersey-signed up personal debt adjuster.

- They aren’t situated in Nj-new jersey.

- They’re not ready to help you visit Court or prevent a beneficial sheriff deals.

Who’s the current Servicer?

The loan modification application should be published to the current financing servicer. This can be normally the providers that’s giving this new month-to-month financial comments. The latest monthly report can get vital information such as the financing amount, interest rate, fee amounts, amounts owed and address used to speak into the Servicer. It is essential to open all of the mail since the Upkeep can Redstone Arsenal loans be feel directed of course, if you send the application form towards the incorrect servicer, there is no possibility to end a property foreclosure otherwise rating a good amendment.

Understanding the Proprietor/Trader can be the most important piece of advice offered and you will will say to you what types of modifications could be offered. Should your mortgage are Federally Backed, definition its that have FHA (Government Houses Power), Virtual assistant, Fannie mae or Freddie Mac computer, your amendment programs is actually publicly offered additionally the Servicer need certainly to abide of the them. You can find out in the event your financing try Federally Backed owing to these types of queries:

- See if The loan is actually Belonging to Fannie mae Here

- Find out if The loan was Owned by Freddie Mac computer Here

In case the financing is not Federally Backed, the fresh amendment apps might be computed depending a binding agreement between the master/Buyer together with Servicer. Certain Citizens/People have specific direction and illustrate brand new Servicer with what type of Changes they could offer. Although not, other Residents/Dealers allow the Servicers to see which Modification Software to offer. You can try to find out the master/Buyer by calling this new Servicer, nevertheless most practical method should be to publish a composed Obtain Advice (RFI) on the Servicer and inquire the name of Manager/Buyer. If for example the RFI is sent on designated address, from the official send, the latest Servicer Have to function in writing. That it target is needed to get on the latest month-to-month mortgage statement. If there is question from what Holder/Individual, we constantly publish the RFI.

What kind of Amendment System Could well be Utilized?

FHA, Va, Federal national mortgage association and you may Freddie Mac computer all of the provides in public places readily available amendment advice. He is difficult to comprehend and discover, but they are available if in case new Servicer will not follow them, there clearly was reasons behind a federal suit otherwise a safety so you can a foreclosures. New Federally Supported money every features modification applications getting Consumers at the the termination of an excellent Forbearance and Individuals impacted by this new Coronavirus Emergency.

Inside our work environment, i have confidence in a specialist during this period of your processes, Roberto (Bobby) Rivera. My personal clients are informed that i are capable of the newest legalities of processes, but I am not good mathematician. Bobby renders their way of living recording all of the different amendment software from the lenders and you may Servicers and he really works the computations to apply for adjustment. Bobby try exclusively certified. He functions nationwide and also lectured and coached lawyers how-to securely make an application for variations. They can concur that a credit card applicatoin have been in correct function to have a particular Federally Supported mortgage. Likewise, typically we have over of a lot, of several modifications having fund which are not Federally Backed and we track and you may save all the info regarding each amendment, so we have a good idea out of what to anticipate whenever we do a different sort of app to possess good Servicer which have a certain Owner/Trader.