Sign up for home financing inside the Ca Now!

At Defense The united states Home loan, we’re pleased to suffice whoever has offered our very own nation. We help pros as well as their household to view sensible mortgage brokers into the California, through the Virtual assistant, and work out the dream households a real possibility.

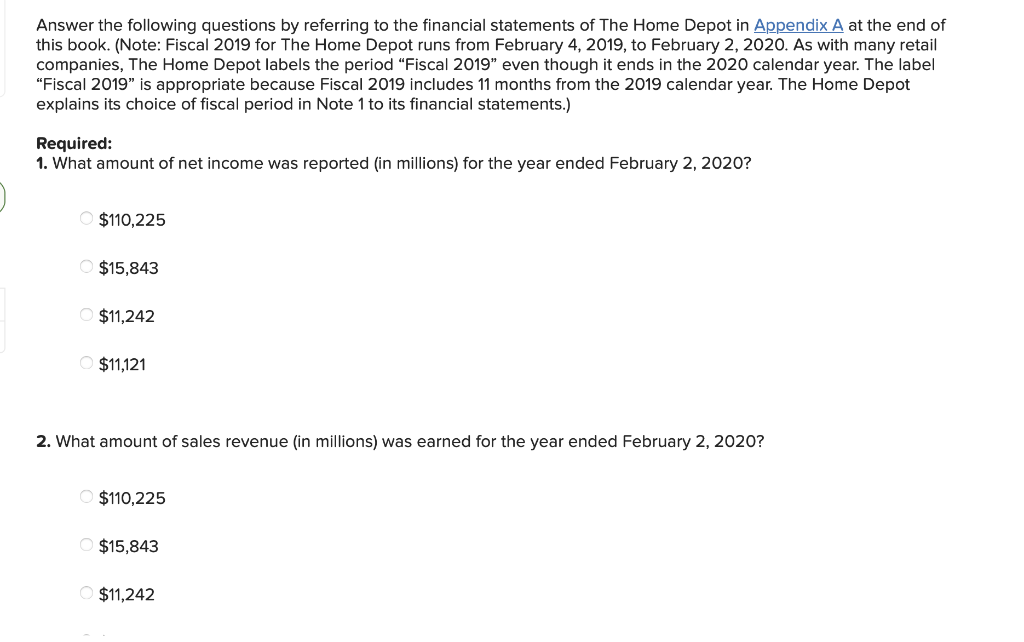

Do you want first off your property financing techniques? Following just fill out new quick that-minute means lower than to get started! We will provide a zero-obligations appointment so you’re able to estimate how much cash you may be in a position to use.

Why must I have a beneficial Va-Backed Financing from inside the Ca?

Having globe-class places for example San francisco bay area and Los angeles, incredible climate throughout every season, and you may a healthier lifestyle, there clearly was several reason you might make use of your Veterans Loan benefit to purchase your fantasy house inside the the brand new Wonderful State.

Simultaneously, financing restrictions inside the Ca vary from condition so you’re able to county, according to homes ento’s average number household deals pricing is $520,000 during the 2022. Generally, Va mortgage constraints pick a giant best-upwards in 2022, for the simple Va financing restrict expanding so you’re able to$647,200 compared to the $548,250 from inside the 2021. The new Virtual assistant loan constraints together with increased having high-pricing counties peaking on $970,800 to own just one-house. Surprisingly, Virtual assistant mortgage limitations are useless getting certified pros having full entitlement. But not, brand new limits however apply to pros without complete entitlement.

Also, VA-Backed Fund wanted a beneficial 0% down-payment most of the time, while conventional finance basically require no less than good step 3% advance payment and frequently to 20% required; FHA money wanted a minimum of 3.5% down-payment. And you will, which have an effective Virtual assistant Home loan, pros needn’t shell out one monthly financial insurance rates, which cannot be said regarding antique otherwise FHA mortgage loans.

What is actually a good Jumbo Mortgage within the California?

Of numerous Pros have cheated their Virtual assistant financing experts. Having informal degree standards and more self-reliance, it is proven to be the right choice for many so you’re able to get and you may re-finance their houses from this program. But not, in some California counties, the new conforming financing limit with no currency down is actually $548,250. Should your household will set https://paydayloanflorida.net/fanning-springs/ you back over it, the clear answer are a great Virtual assistant Jumbo Mortgage. A beneficial Va Jumbo Financing are any Va-Backed Financing bigger than $548,250. And being qualified Experts can use to find otherwise re-finance their residence for a property value $step one,000,000 through this variety of financing, including researching all of the benefits of the general California Va Loan.

They are Secret Experts you to definitely Shelter The united states could offer you discover a Va Money from inside the Ca

- Va, FHA, and all of Home loan Products.

- $0 Downpayment getting Virtual assistant Lenders.

- No need to own Individual Mortgage Insurance rates.

- Aggressive passions cost.

- All the way down Money.

- Simpler to Be considered.

- Everyday Borrowing Conditions.

Virtual assistant Loan Review

Ca Virtual assistant Lenders was fund supplied to army veterans, reservists, and you can productive-obligation players to invest in a first quarters. Brand new Pros Administration will not lend money on the financial; as an alternative, they promises the major 25 % of your money from individual lenders, instance Security America Financial, to the people compliant into Virtual assistant Financing Qualifications standards.

Accredited pros may use their loan positive points to buy a property which have no money off, no individual mortgage insurance, and also have the vendors pay-all their settlement costs. Such experts and you can very competitive rates create Virtual assistant Finance when you look at the Ca, the most used loan option for of a lot experts.

Virtual assistant Financial Rates and you will Can cost you

Virtual assistant Fund within the Ca have the same expenses associated with closure as the other mortgage affairs, however, there are two secret differences in settlement costs with a good VA-Backed Financing. Earliest, in the event the negotiated toward buy bargain, the vendor will pay all settlement costs and you will prepaid activities, totaling as much as five percent of purchase price. 2nd, the fresh new Institution out-of Experts Activities charge a beneficial Virtual assistant Capital Fee towards the all financing it guarantees.

The Va Funding Fee are repaid straight to the Va and you can helps buy your house Financing System for everybody newest and you may future homeowners. It Percentage selections in one.25 % to three.step 3 percent but is waived to own pros which have solution-linked handicaps. Together with, the latest Va Money Fee is going to be paid-in full or rolled to your mortgage from the closure.

Normally, the attention prices for Virtual assistant Fund inside the Ca was lower when compared to traditional and you may FHA loans. Still, you can visit all of our Virtual assistant Online calculator so you’re able to dictate your payments!