With regards to to order a home, your credit rating performs a significant part from inside the deciding the kind off mortgage you could potentially be eligible for therefore the interest rate it is possible to discovered. A credit score off 650 is known as fair but can maybe not grant you usage of many positive loan terms and conditions. Inside post, we will mention just how much out-of a mortgage you can buy having a great 650 credit rating and you will you Nucla loans skill so you can replace your candidates.

Expertise Credit scores and you may Mortgage brokers

Basic, let’s describe what a credit rating try and just how they relates so you’re able to mortgage brokers. Your credit rating are a mathematical representation of your creditworthiness, considering your credit score, along with factors including percentage history, a fantastic expense, while the duration of your credit report. Lenders use this score to assess the possibility of credit so you can you.

The fresh Perception from an effective 650 Credit rating

A credit rating out-of 650 is considered reasonable, however it is underneath the tolerance for advanced level (above 800), very good (740-799), and you can a great (670-739) fico scores. Here is how it does affect your home financing choice:

Financing Eligibility: That have a credit history from 650, you might generally speaking qualify for government-recognized funds such as for instance FHA (Government Construction Government) funds or Va (Veterans Affairs) funds, which have a whole lot more lenient credit rating criteria. Yet not, their qualifications to possess conventional money (those not supported by the government) are restricted, and you may face highest interest rates.

Interest levels: Your credit rating significantly has an effect on the speed you’ll get for the your house loan. Having a great 650 credit history, it’s also possible to receive a top interest compared to borrowers which have highest scores. A high interest mode you’ll spend more into the notice more than living of your financing.

Amount borrowed: The amount of our home mortgage you can aquire with a good 650 credit score depends on various issues, as well as your money, debt-to-income ratio, while the lender’s rules. Lenders normally pick a debt-to-income proportion lower than 43%, which means your monthly bills (such as the home loan) cannot surpass 43% of monthly income.

Figuring Your residence Amount borrowed

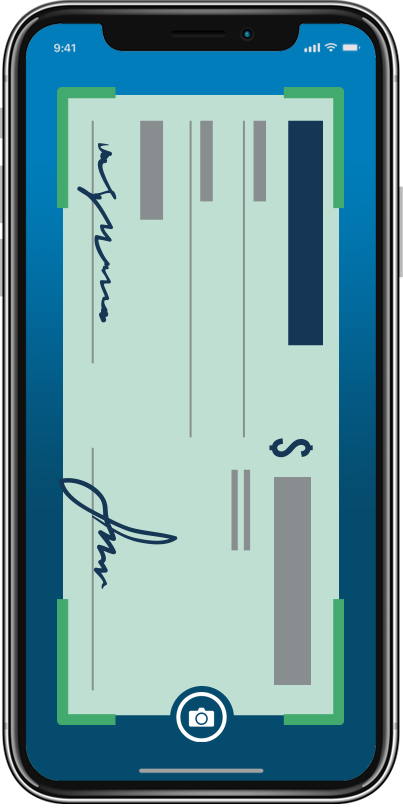

To estimate just how much away from a mortgage you should buy having an effective 650 credit rating, you are able to the following steps:

Calculate Your debt-to-Earnings Ratio: Seem sensible their month-to-month debt costs (handmade cards, auto loans, figuratively speaking, an such like.) and you will separate by the disgusting monthly earnings. Multiply the result by 100 locate a share.

Guess Your home Loan: Lenders normally have fun with a personal debt-to-earnings proportion out-of 43% or all the way down. Thus, in case the terrible monthly money was $5,000, your restriction allowable month-to-month financial obligation repayments could well be $2,150. Deduct your existing month-to-month loans costs using this total imagine maximum mortgage repayment you really can afford.

Play with a mortgage Calculator: You can utilize online home loan hand calculators so you’re able to guess the mortgage count you can afford centered on your month-to-month mortgage payment and you may interest rate.

Enhancing your Financial Applicants

When you find yourself an effective 650 credit rating you’ll curb your options, there are activities to do adjust your creditworthiness and enhance the amount borrowed you could potentially be eligible for:

- Alter your Credit rating: Work at boosting your credit rating by paying expense timely, cutting bank card balances, and you may handling people problems on your own credit history.

- Improve Advance payment: A more impressive deposit normally offset a lower life expectancy credit score and improve your financing terms and conditions.

- Decrease your Financial obligation: Reduce present debts to minimize your debt-to-money proportion.

- Look around: More loan providers has actually varying credit rating standards and you will mortgage software. It makes sense to understand more about several lenders to find the best terms for your situation.

To summarize, when you’re a good 650 credit rating may restrict your financial solutions and you can lead to higher interest rates, it’s still you are able to to help you safer a home loan. By using strategies to improve your credit rating and you may managing the funds sensibly, you could potentially enhance your probability of qualifying to possess a more positive home loan.