Score a free of charge, zero obligation personal bank loan quotation that have rates as low as nine.90%

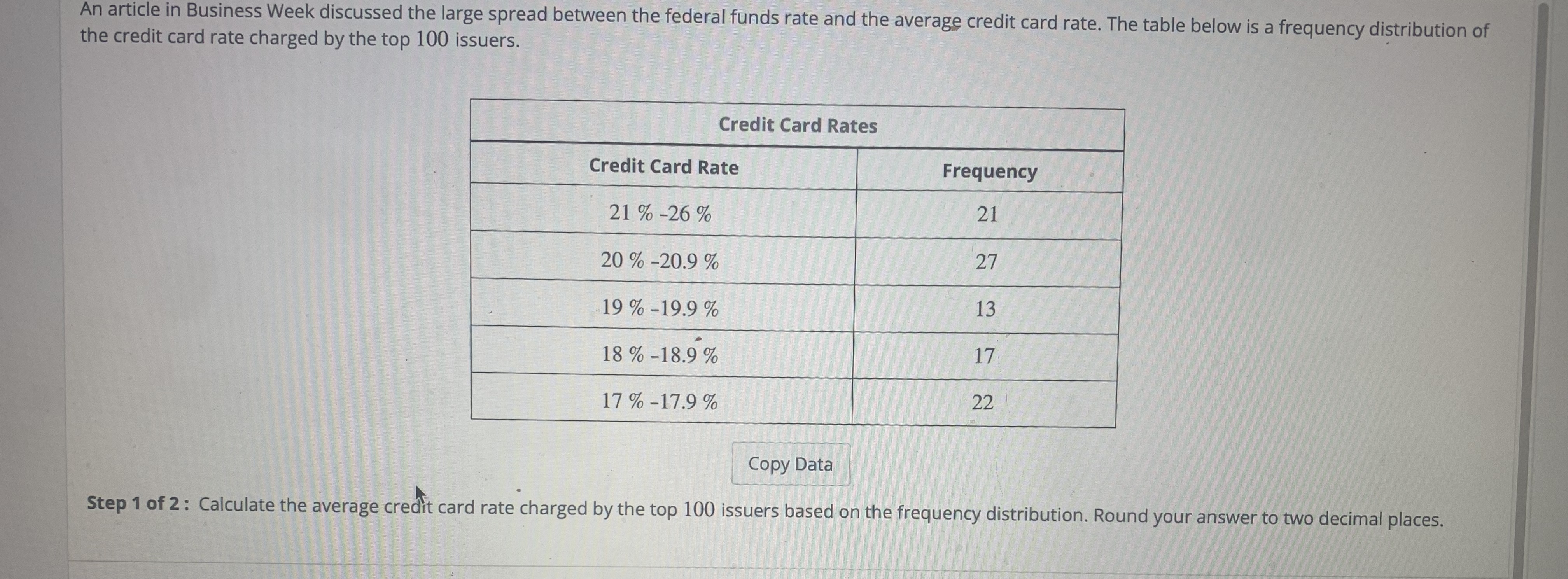

There are 2 more terms and conditions from the yearly interest levels that are used on your debts, annual percentage pricing (APR) and you will annual rates of interest (AIR). Attention can be difficult to discover but with specific general education about how exactly it’s calculated as well as how its used on your financial situation, you’re going to be more lucrative in the handling your finances. Here is everything you need to see to learn Annual percentage rate vs Heavens

What is actually Sky?

Quick to have Annual Interest, Sky refers to the estimated quantity of attention that you will pay annual so you’re able to acquire a specific amount of loan dominant, like you would see which have a personal loan otherwise financial. Your Sky are presented just like the a predetermined otherwise variable commission and lenders have a tendency to generally assess they using this equation:

- Complete Desire ? Loan amount ? Period of Installment Term

Many loan providers play with Annual percentage rate (APR) when comparing the price of various other financing products, it doesn’t usually generate as the particular out-of a statistic once the Annual Rate of interest (AIR) does, particularly when you are looking at cost-centered fund.

Otherwise known as an excellent declining equilibrium financing, fees financing include a-flat contribution, and therefore will get down whenever you make an installment. Your financial would be to merely costs attract towards the harmony one stays. If the rate is actually fixed, it won’t alter via your financing title and if its variable, it fluctuates having Canada’s best borrowing rates.

What’s Annual percentage rate?

To truly understand Air, you must and additionally understand Apr or Annual percentage rate, the yearly interest rate you to definitely lenders charge a fee to help you use from them.

- Loan’s periodic interest rate (price charged four weeks)

- Total loan dominant

- Sized their monthly mortgage payments

- Number of days on your own payment term

- Costs and you will attention billed over the longevity of the borrowed funds

- People deals which might be used

There are some types https://paydayloanflorida.net/raleigh/ of Annual percentage rate you to definitely lenders affect some other borrowing products, eg handmade cards, payday loans and you may personal lines of credit. Annual percentage rate is additionally put on money membership to find the yearly speed a trader earns rather than compounding interest.

How-to Determine Sky vs Apr

Contemplate, brand new Yearly Rate of interest (AIR) ‘s the portion of the mortgage dominating you to a lender costs your annual so you’re able to borrow money from their website. Apr (ount of great interest that you must spend from year to year, just they encompasses all the will set you back involved with the loan. Here’s a few out of earliest instances:

Figuring Sky

As mentioned, their Yearly Interest rate was computed by using the entire yearly interest the bank fees you, splitting it by your loan amount, up coming separating that matter by the length of their installment name. Let’s say that you have:

- $5,000 of interest towards a beneficial $50,000 unsecured loan, which have a two-year title

- $5,000 ? ($50,000 ? 2) = 0.05 otherwise 5.00% Air

Understand that this is simply a simplified technique for figuring another person’s Yearly Interest. If for example the lender actually assigns their Sky, its choice depends toward additional factors, such as your money, credit history and you can financial obligation top. The greater debt health was complete, the newest quicker chance you have got from defaulting on your loan money down the road. This is why, the lending company may offer your a larger mortgage that have a lower Heavens and you may a lengthier title.

Figuring Annual percentage rate

To deliver a much better thought of just how Annual percentage rate works, let us use this new formula shown above to the exact same analogy (an effective $fifty,000 mortgage which have $5,000 notice and you may a two-season identity), simply this time we are going to include a 1% ($550) origination percentage to make it so much more sensible: