Family appraisal

Many of conditional funds feature a supply into the completion out-of a professional domestic assessment, that renders sure the actual property value the house aligns having the level of your residence mortgage. You may also be unable to secure last mortgage recognition when your mortgage number exceeds the value of the house or property you are to acquire.

Many lenders require also the culmination off property examination previous in order to closing. This action ensures that there are not any visible difficulties with the new assets that will result in a critical financial hardship towards debtor.

Gift letters

Often, potential homeowners receive economic merchandise regarding friends and family players so you’re able to coverage the cost of a down payment. While this will likely be an effective selection for securing dollars to possess a down-payment, a weird lump put into the bank account may cause some lenders to question when it money is that loan otherwise a beneficial current.

In order to calm these questions, your own financial may require that obtain a gift page out of some one getting a substantial amount of currency to the your own down-payment. Which letter just says your money considering are a present and never that loan.

Home insurance visibility

A new popular condition many lenders attach to good conditional mortgage is the necessity with the homebuyer to purchase homeowners insurance. Many loan providers do an escrow membership you to definitely lets an effective homebuyer create monthly obligations into the the yearly home insurance advanced. That it escrow amount becomes section of their monthly home loan repayments, along with your homeowners insurance advanced is immediately settled using this membership.

Alternatively, you may pay this type of premiums yourself and you may ount. In either case, odds are your own financial will require that confirm that you’ve got adequate homeowners insurance exposure before closure on your financing.

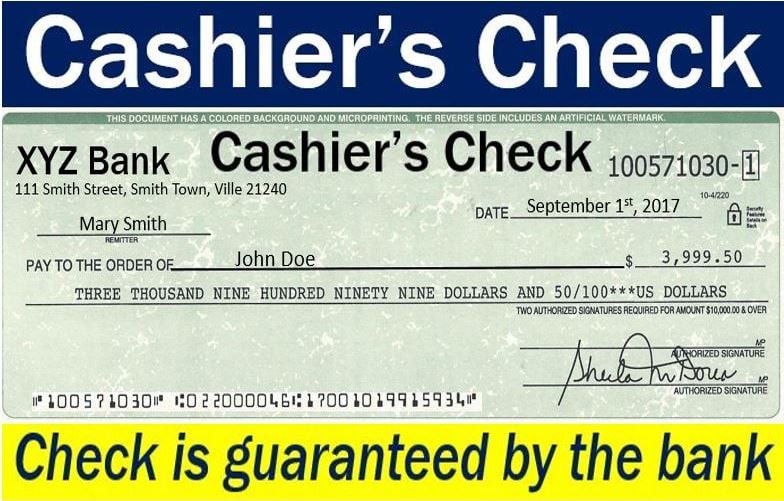

Good faith money

Certain loan providers or sellers need one to build an excellent believe efforts by deposit a specific portion of the loan really worth towards a keen escrow membership. This deposit, also known as good-faith currency, assists fortify the consumer’s condition by letting the lender or provider know he is dedicated to making the purchase.

On closure, this good faith money can go on the brand new downpayment getting your house. not, for people who back outside of the product sales, you exposure losing your bank account as this deposit is actually low-refundable occasionally. If the lender demands a good-faith currency put, it is crucial to get the information on this arrangement written down. Make sure to have a look at conditions loan places Hartselle and terms and that means you grasp their debt below these arrangement.

Sometimes, you could potentially safer preapproval to possess a home loan in just an excellent matter of a few short days. At the same time, conditional loan recognition usually takes to 2 weeks or lengthened to accomplish. After you find property we want to buy, you might proceed which have securing last loan approval.

The amount of time it will take locate which finally acceptance depends on just how long it requires one fulfill most of the arrangements regarding the newest conditional financing. In order to speed up this step, bear in mind the fresh tips you really need to complete to order a house, for example a property examination and you can possessions assessment. Stay in close experience of the loan administrator and try to give one papers and you will files as soon as possible.

Our bring

While many realtors only need one obtain preapproval to own an effective mortgage, taking the even more step so you can secure a beneficial conditional mortgage also provide power whenever discussing into merchant. A great conditional mortgage recognition also can leave you comfort realizing that the lending company tends to grant last approval and you can tells you from the beginning just what various criteria you might have to meet just before closing.

Whenever making an application for a mortgage loan, it is important to assemble this information to one another. Basic, this ensures that you will be offering the financial with perfect recommendations possible. Second, these types of records was available in the event your lender desires them.